President Trump’s national security probe under Section 232 of the Trade Expansion Act of 1962, launched in February to review raw copper, refined copper, copper concentrates, copper alloys, scrap copper, and other copper derivatives imported into the U.S, directed the Commerce Department to deliver tariff recommendations to the White House within 270 days. That review process has likely been accelerated, as a new report suggests U.S. copper imports could be enacted in the near-term.

Sources told Bloomberg that the Trump administration is moving quickly with its review of copper import tariffs and will likely act well before the 270-day deadline, which was expected between September and November. The new timeline has now shifted to mid-May.

Commenting on the shortened timeline, Goldman’s Eoin Dinsmore, Aurelia Waltham, and others provided clients with a critical Q&A addressing physical market flows and pricing across various exchanges:

What is the impact on physical market flows?

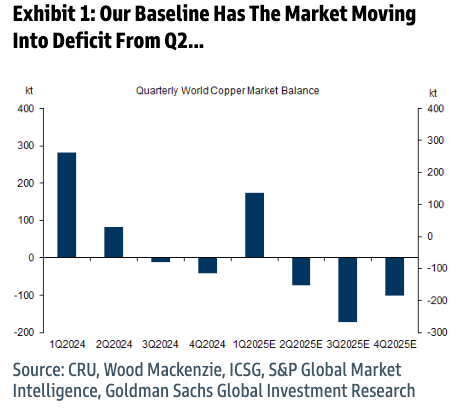

Greater certainty on copper tariffs means COMEX is likely to trade at a higher premium to LME, but there is less time to ship metal to the U.S. Assuming tariffs are implemented in May, we think shipments to the U.S. will likely be fast tracked, with net imports in April potentially jumping 200kt[1] above the standard 60-70kt/month, albeit with upside risk. However, with the possibility of earlier tariff implementation, we now expect U.S. stocks to decline by 30-40kt/month from mid-to-late Q2 onwards. Thus, we avoid a stock glut in the U.S. in Q3 2025, when we expect global copper market tightness to be most pronounced. […]

— Read More: www.zerohedge.com